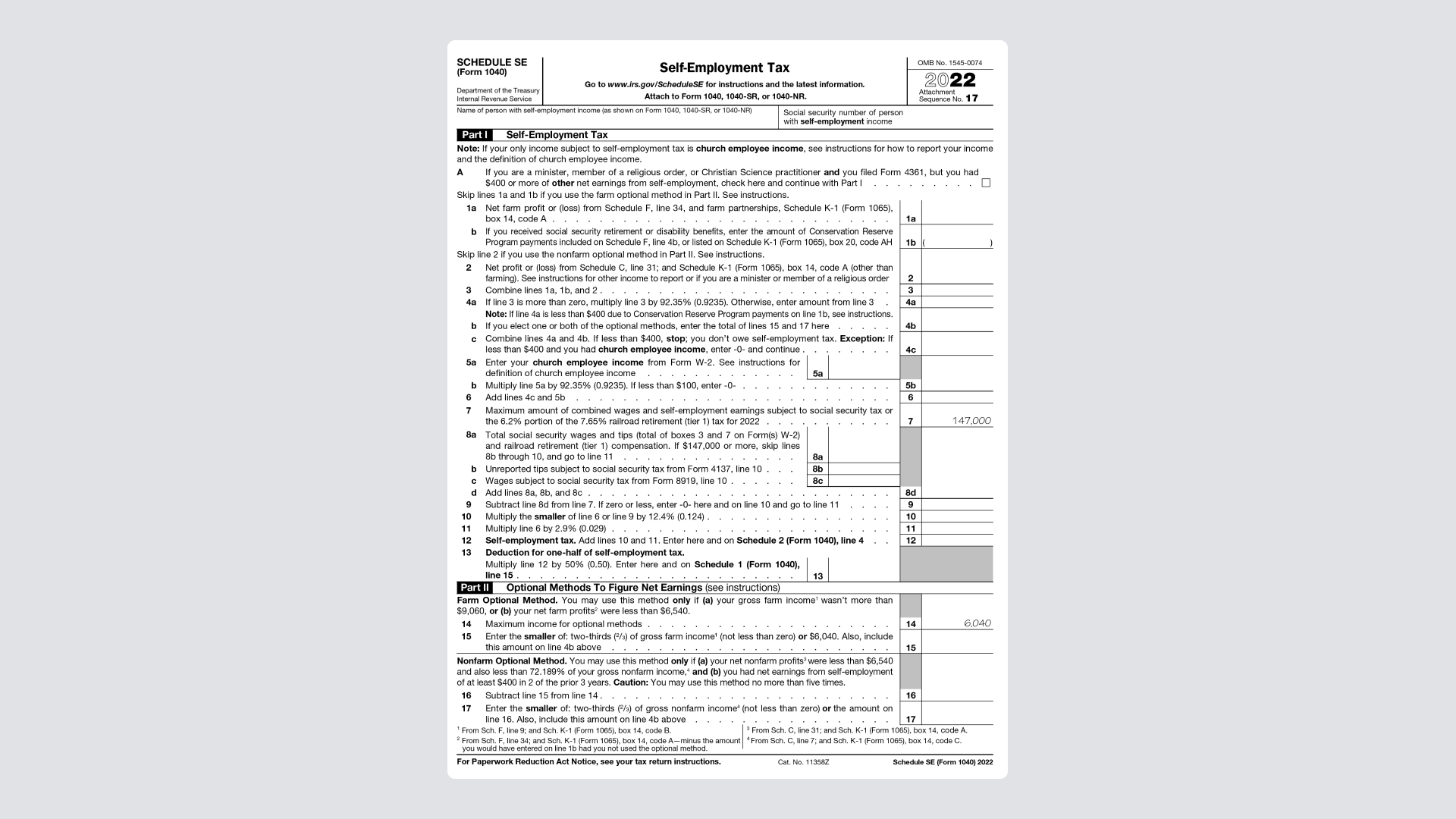

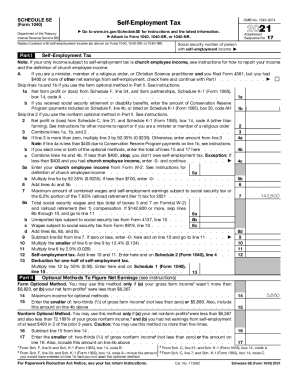

2024 Schedule Se 1040 – To report and pay self-employment taxes, fill out and file Schedule SE with your 1040 tax return. Most state LLC statutes allow for single-member LLCs — limited liability companies with only one . Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” With these two forms, you are able to report your business .

2024 Schedule Se 1040

Source : found.comIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comSE1204 Form 1040 Schedule SE Self Employment Tax (Page 1 & 2

Source : www.greatland.com2023 Schedule SE (Form 1040) (sp): Fill out & sign online | DocHub

Source : www.dochub.comSE1204 Form 1040 Schedule SE Self Employment Tax (Page 1 & 2

Source : www.nelcosolutions.com2023 Form IRS Instruction 1040 Schedule SE Fill Online

Source : tax-form-1040-instructions.pdffiller.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govIRS Instruction 1040 Schedule SE 2022 2024 Fill and Sign

Source : www.uslegalforms.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co2023 Form IRS 1040 ES (NR) Fill Online, Printable, Fillable, Blank

Source : form-us-estimated-tax.pdffiller.com2024 Schedule Se 1040 A Step by Step Guide to the Schedule SE Tax Form: These taxes are calculated using Schedule SE with your Form 1040 tax return. If you have multiple sole proprietorship businesses, you typically combine the results of these into a single amount . TaxAct, 1040.com and our top overall choice for freelancers, TaxSlayer, are just some of the IRS Free File Partners that offer forms Schedule SE, Schedule C and 1099-NEC at no cost. There are some .

]]>