Section 179 Deduction Vehicle List 2024 Excel – Property that qualifies for this tax break includes machinery, tools, furniture, fixtures, computers, software and vehicles. (This special rule often goes by the alias “the Section 179 deduction . After record-high used vehicle prices declined notably in 2023, pricing is expected to be relatively stable through the 2024 calendar, according to a report from Cox Automotive. The automotive .

Section 179 Deduction Vehicle List 2024 Excel

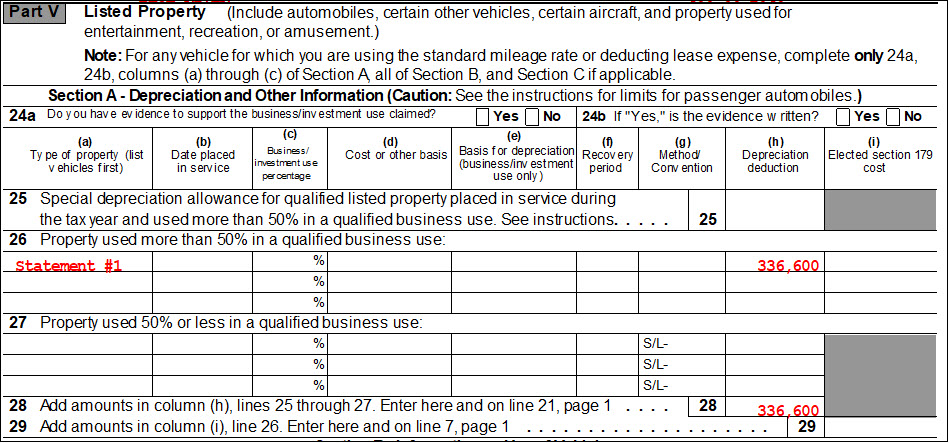

Source : over6000pounds.com4562 Listed Property Type (4562)

Source : drakesoftware.comSingle Entry Bookkeeping Essentials For Beginner

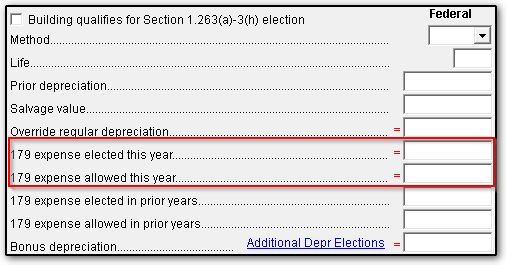

Source : www.xoatax.com4562 Section 179 Data Entry, Common Issues, Limits

Source : drakesoftware.comHow to CALCULATE numbers for IRS taxes: pen and paper

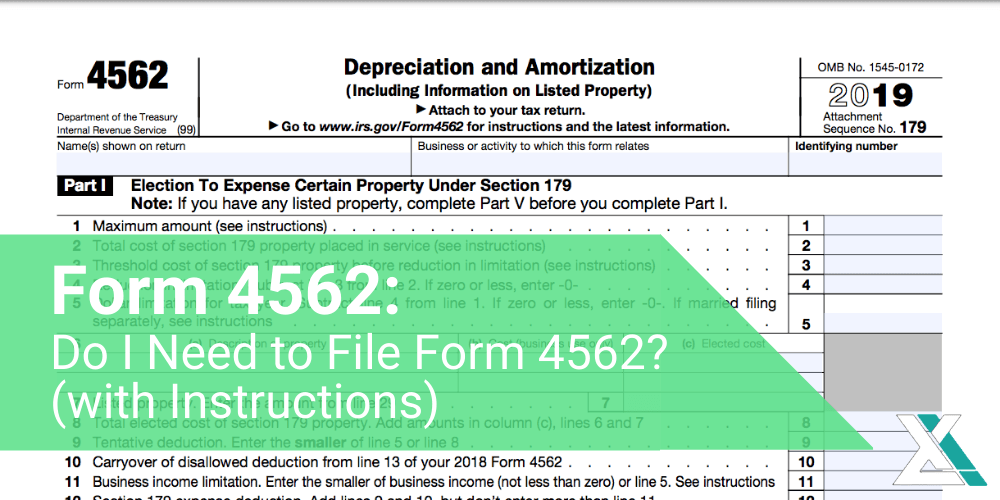

Source : seattlebusinessapothecary.comForm 4562: Do I Need to File Form 4562? (with Instructions)

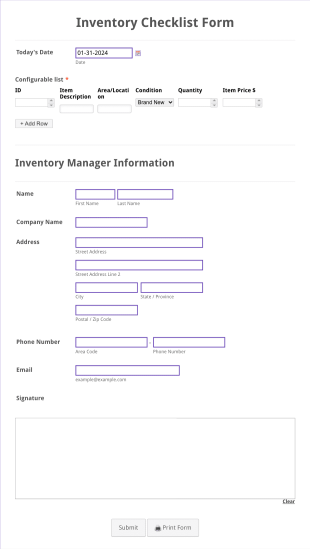

Source : www.excelcapmanagement.comInventory Checklist Form Template | Jotform

Source : www.jotform.comForm 4562: Do I Need to File Form 4562? (with Instructions)

Source : www.excelcapmanagement.com2024 Ford Ranger® XL Truck | Model Details & Specs | Ford.com

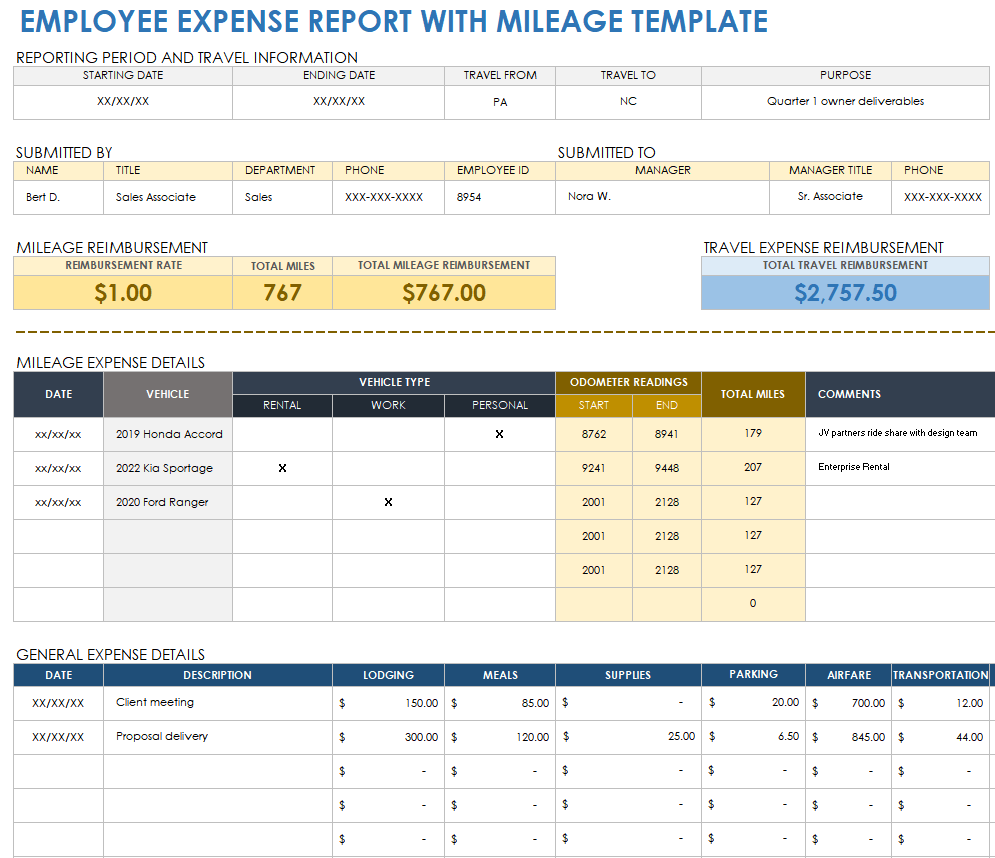

Source : www.ford.comFree Excel Expense Report Templates | Smartsheet

Source : www.smartsheet.comSection 179 Deduction Vehicle List 2024 Excel Electric Vehicles That Unlock the 6000 lb Tax Credit: (NewsNation) — The start of 2024 marks the beginning of a new tax year, which means higher federal income tax brackets and increased standard deductions that could lead to more take-home pay for . You have to understand the time period that regular depreciation allows as well as options for bonus depreciation or Section 179 deduction You purchase a vehicle for $30,000. .

]]>